Imagine being a professional golfer and teeing up for a shot using just a whiffle ball: such a waste of unrealized potential! In wealth management, you can find yourself unable to serve clients to their fullest, and it’s often because you’re unsupported and ill-equipped to excel. That’s why at Freestone, we give our advisors strong, in-house tools to focus on what you do best: Help your clients.

In this piece we’ll cover:

- How we leverage technology to provide additional client value and offer opportunities to gain additional business, such as outside asset capture

- Why our in-house resources allow you to spend more time with your clients and less time acting as your client’s CFO

Opportunity knocks for you and your clients, with asset capture

It’s difficult to advise your clients financial goals when you only have a partial financial picture. But that’s typically the reality and can occlude what’s really possible for their financial future. More accurate inputs bring more accurate outputs, but conversations about outside assets can feel like an imposition or even distasteful. At Freestone, we leverage technology to introduce captured asset opportunities.

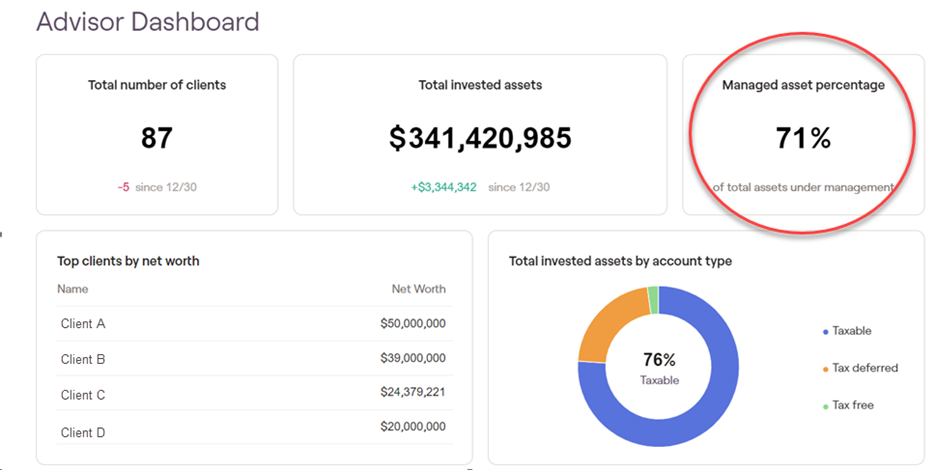

Conversations around financial planning, and the technology to demonstrate an encompassing view of your client’s assets provide a natural lead into conversations about all your client’s assets. Our software quickly shows you your total assets managed across all clients so you can easily see where you can start to provide additional value.

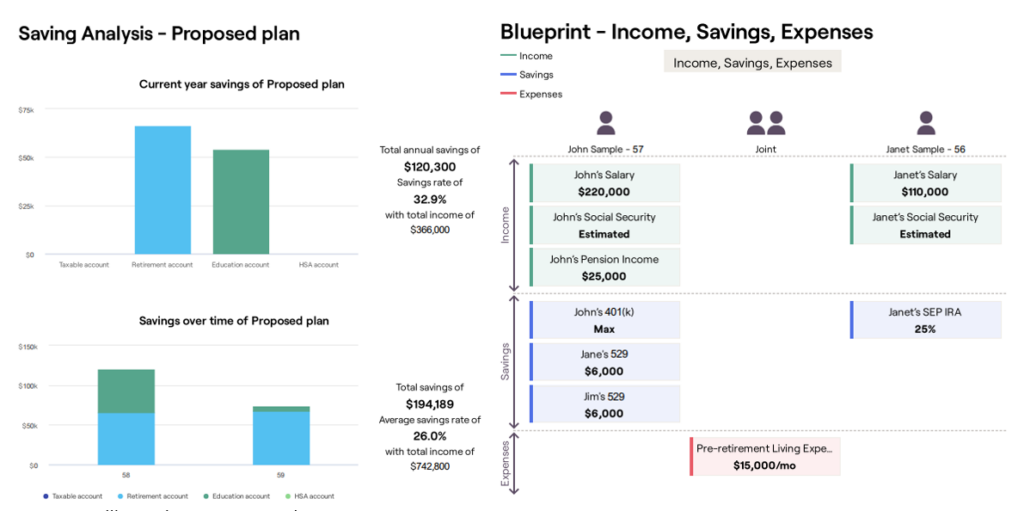

With a complete financial picture, you can add much more value to your clients. Over 56% of our clients (and counting) have financial plans built. The holistic view of their entire financial pictures in a visually appealing and easy to digest analysis of their retirement plans, savings goals, etc. adds valuable insight for you and the client.

At Freestone, you have people, and answers.

Spanning the full wealth spectrum, from the growing affluent to wealth transfer—calls for a team of in-house experts who can readily create and steward the path of a client’s financial journey. We offer that.

You benefit from our multi-faceted team of in-house experts, resources you can lean into for what truly matters to the client at any given time, for any given situation. While some advisors might work personally with their clients’ designated CPAs, attorneys and other professional services, we maintain in-house experts to quickly and effectively answer many hard-hitting client questions.

You’ll spend more time with your clients and less time researching that new legislation passed by congress and its implications, because you have a team to help navigate those complexities (take the Secure Act. 2.0, as an example). Additional value comes from our in-house wealth strategist, who reviews estate plans and can suggest proposals that can have a huge tax impact. Last year, our wealth strategist answered questions pertaining to or reviewed over 85 estate plans, saving more time and money for our clients. Singular insights like this can more than cover a client’s investment management fees over the life of the entire relationship.

Less minutiae; more quality client time

With Freestone’s team backbone, you can offset the burden of managing external relationships. Time spent communicating with your clients’ other trusted advisorsis important, but ultimately, that’s time you could be spending directly with your clients. Our in-house wealth strategy team and dedicated client service team alleviate a lot of back-and-forth to give you back more client time. For advisors who want to better leverage their time and grow their practices, moving to a team-supported wealth services firm such as Freestone might be just the leap worth taking.

You work hard planning your clients’ futures; what about your own?

Change is daunting, but feeling stifled can be soul-crushing. We continue to do right by our clients with a broad range of services and investment options, but we also create opportunities for our advisors to do their best and most focused work.

Ready to leave no stone unturned?

Freestone is looking for advisors who put their clients first. If you’d like to learn more about how we approach financial planning or other business-related initiatives, we’d like to hear from you. Schedule a time with our Director of Recruiting to learn how Freestone could help in the next phase of your career. Schedule a call today.

Disclosures: The information shown on this page is for discussion purposes only. This page provides general information that is only a summary of certain employment benefits that we believe might be of interest. Information shown on this page is not intended to be relied on for any employment decisions nor is any of this information a guarantee of employment terms. Information shown are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise of any change in such information in the future.