Most U.S. tax payers are well-versed on §401(k) and §501(c)(3), but how well do you know §1031?

Like most provisions of the Internal Revenue Code, the devil is in the details, and an exchange of property must be carefully crafted in order to qualify for §1031 treatment. Below are several, although not all, of the key factors to consider:

- The seller may not directly receive funds from the sale of the relinquished property. Sale proceeds must flow through what is called a “Qualified Intermediary” who acts on behalf of the seller to transact the exchange, dispose of the relinquished property and acquire the replacement property

- Most exchanges “trade up,” as any proceeds not reinvested into the replacement property are subject to tax

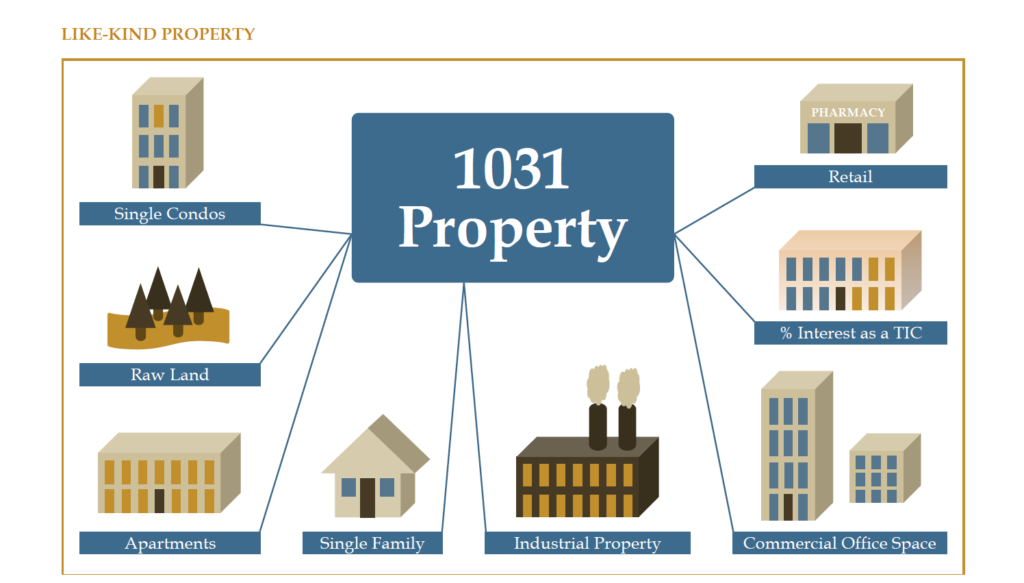

- The definition of “like-kind” can be broadly interpreted. An investor can exchange a ranch for a strip mall and a skyscraper for raw land. However, you cannot exchange property for securities in a REIT, a limited partnership or a corporation

- Vacation properties and second homes generally have more requirements to qualify for §1031 treatment, for example:

- The property generally must have been held as an investment property for 24 months

- The property must have rented for at least 14 days each year

- The property must not have been used personally for more than 14 days or 10% of days rented

- IRS “safe harbor guidelines” from Revenue Procedure 2008-16 apply

- “Identification” is the process in which potential replacement properties are identified to the Qualified Intermediary. The potential replacement properties must be identified within 45 days of the original sale of the relinquished property. The following rules are used in the identification process:

- Three Property Rule – can identify any three properties regardless of value

- 200% Fair Market Rule – can identify four or more properties provided the total value does not exceed 200% of the property sold

- 95% Exception – if the value of identified properties exceeds 200% of the relinquished properties, then 95% of what is identified must be purchased

- Finally, the §1031 purchase transaction must be completed within 180 days following the closing of the sale of the relinquished property.

Unacceptable Like Kind Property

- Property held primarily for sale (i.e., property held by a developer, “flipper” or other dealer)

- Foreign property (real or personal) for U.S. based property, or vice-versa

- Intangible ownership:

- Stocks, bonds or notes

- Certificates of trust or beneficial interests

- Interests in a partnership

- Choses in action (rights to receive money or other property by judicial proceeding)

- Goodwill of one business for goodwill of another business

Done right, the §1031 exchange can be a powerful tool. Freestone’s investment team often uses §1031 transactions in an effort to manage the potential tax implications of purchase and sale activity in our real estate oriented funds. Clients with investment real estate can also engage in this type of transaction in an effort to reduce current tax liability and potentially help with estate planning. If you have a situation where a §1031 exchange may be appropriate, please don’t hesitate to contact your Freestone advisor team. We will help with general questions and can put you in touch with specialists who can assist you.

We encourage you to contact a Client Advisor with any questions.

Important Disclosures: This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward thinking statements” and are subject to a number of significant to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.