When it comes to integrating philanthropy into estate planning, we believe few tools offer the flexibility and impact of Donor-Advised Funds (DAFs). These funds provide a strategic, tax-efficient way to manage charitable giving while ensuring that your values and goals live on through your legacy. For high-net-worth individuals and families looking to make a long-term impact, DAFs are an essential tool to consider.

In this article, we’ll explore the power of DAFs in legacy planning, covering everything from their tax advantages to how they can bring your family together in philanthropy.

What Are Donor-Advised Funds (DAFs)?

A Donor-Advised Fund is essentially a charitable investment account that allows you to contribute cash, securities, or other assets, receive an immediate tax deduction, and then recommend grants to qualified charitable organizations over time. Once the contribution is made to the fund, it’s irrevocable, meaning it is legally a charitable gift. However, as the donor, you maintain control over how and when the funds are distributed to the causes that matter most to you.

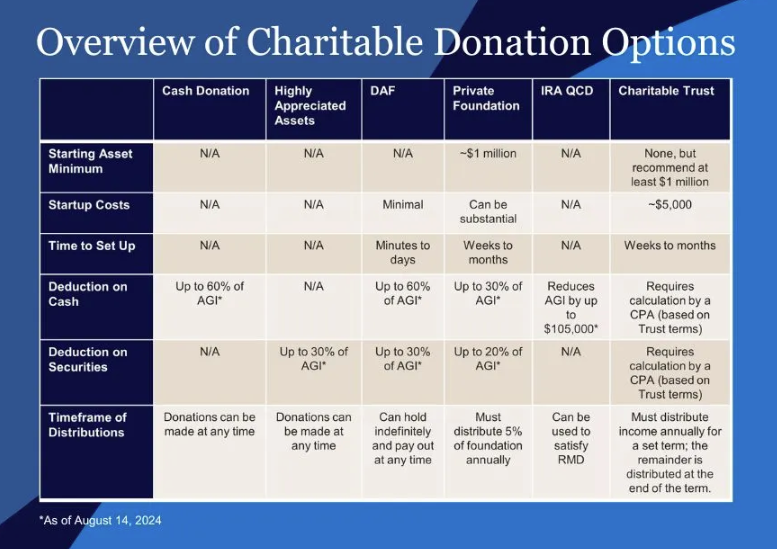

DAFs vs. Private Foundations and Charitable Trusts: A Tax Comparison

Compared to private foundations or charitable trusts, Donor-Advised Funds often provide more favorable tax benefits with fewer administrative burdens. For example, contributions to DAFs typically allow for a higher immediate charitable deduction—up to 60% of adjusted gross income (AGI) for cash donations—compared to the 30% limit for private foundations[1]. Additionally, there are no annual distribution requirements, as is the case with foundations, which must distribute at least 5% of their assets annually. DAFs also avoid the complexities of self-dealing and excise taxes that foundations must navigate, making them a simpler and more tax-efficient option for many high-net-worth donors. Meanwhile, charitable trusts, while useful for some estate planning needs, often involve more complex legal structures and may not provide the same immediate tax benefits found with a DAF.

Strategic Use of DAFs in Estate Planning

From an estate planning perspective, DAFs offer a powerful way to manage taxes and charitable contributions. Since contributions to a DAF are immediately deductible, they can reduce your estate tax exposure because any gifts from your estate to charity will qualify for a charitable deduction. At the same time, your family could continue to retain control over the timing and recipients of your charitable distributions. Your estate plan could even provide guidance to your family members on what causes you wish them to focus on when making distributions from the DAF, which would allow your charitable legacy to continue after your passing.

Engaging the Next Generation in Philanthropy

Unlike giving funds directly to charitable organizations, DAFs will allow you to hold the funds in the DAF account until you are ready to make a distribution. The assets in your DAF can grow over time, allowing you to take a more strategic approach to your charitable giving. You can recommend grants in the future, enabling long-term support for causes that align with your philanthropic goals. One of the biggest benefits of this is that it allows you to engage family members in the charitable process. As your DAF continues to grow, you might consider involving children or grandchildren in discussions about philanthropy and give them the opportunity to participate in choosing causes and organizations that reflect shared values. We believe this involvement not only passes on the spirit of giving but might also strengthen family bonds as you work together to support meaningful causes.

By naming younger family members as advisors or successors to the DAF, you can ensure that future generations continue your legacy of giving. It also allows them to learn about financial responsibility and the importance of making a positive impact on the world.

Conclusion: Why DAFs Are Ideal for Legacy Planning

Donor-Advised Funds are an exceptional tool for anyone looking to integrate charitable giving into their estate plan. They offer immediate tax benefits, long-term flexibility, and the ability to involve family members in meaningful philanthropy. By using a DAF, you can ensure that your charitable legacy endures, supporting causes you care about for years to come.

If you’re looking to build a legacy through philanthropy, consider the advantages of Donor-Advised Funds in your estate planning strategy. The flexibility, control, and tax benefits they offer make them a powerful option for high-net-worth individuals and families seeking to make a difference.

Discover how Donor-Advised Funds can help you build a lasting charitable legacy. Contact us today to learn more about integrating DAFs into your estate planning.

Looking Ahead: Optimizing Wealth Transfer Through Strategic Gifting

As we’ve seen, Donor-Advised Funds (DAFs) can play a crucial role in creating a lasting philanthropic legacy. But DAFs are just one piece of the puzzle when it comes to comprehensive estate planning. In Part 2 of our series, we’ll dive into strategic gifting techniques that not only help reduce taxes but also efficiently transfer wealth to your heirs. Stay tuned as we explore tools like SLATs, GRATs, QPRTs, and ILITs, and how these strategies can further enhance your legacy while benefiting future generations.

Important Disclosures: This article is not intended to provide, and you should not rely upon it for accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any financial planning, investment or tax strategy, and you should not make any financial planning, investment or tax decisions based on the information in this article. This article is intended to be educational in nature and to discuss a few limited aspects of very complex legislation or other complex subject matters. This article is not a comprehensive or complete summary of considerations regarding its subject matter. We recognize that every individual has different needs and opinions expressed in this article may not be appropriate for everyone. Please consult with a Freestone client advisor, accountant, or lawyer regarding options specific to your needs. Please note that Freestone does not approve or endorse any third-party content hyperlinked to in this article.

[1] Source: Vanguard Charitable: https://www.vanguardcharitable.org/dafs-vs-private-foundations